Apply for your 'Home Loan Savings Consultation' and take the first step toward saving up to $80,000 on your next home loan.*

We help health care professionals get approved with just a 10% deposit. Save thousands and get approved faster with lenders who understand your income.

Why Health care Workers Struggle To Get Approved

To the Health Care Worker who just wants a fair go,

You work long hours helping others stay healthy.

But when it comes to getting your own home loan, the banks don't seem to understand your situation.

Whether you're on rotating shifts, fixed-term contracts, or casual hours, you're not the typical borrower in their eyes.

That can mean delays, rejections, or missed opportunities.

We’re changing that.

At LTE Loans, we specialise in helping Health Care Professionals like you secure fair home loans, without judgment and with lenders who actually understand your income structure.

Here's how we do it:

Save up to $80,000 by avoiding Loan Mortgage Insurance (LMI) , high interest rate and fees*

Use your overtime or contract income to qualify

Get fast pre-approvals without the runaround

Borrow up to 90% LVR with no LMI

Boost your borrowing power with overtime income included in your servicing

Access competitive interest rates from multiple lenders

Here’s how it works:

Complete our 60-second form

Speak to the LTE team to discuss your situation and goals

We'll research 25+ lenders to find the options most suitable for you

We handle the paperwork & you enjoy the savings.

You won't pay us directly. We’re paid by the lender once your loan settles, so there's no out-of-pocket cost for using our service.

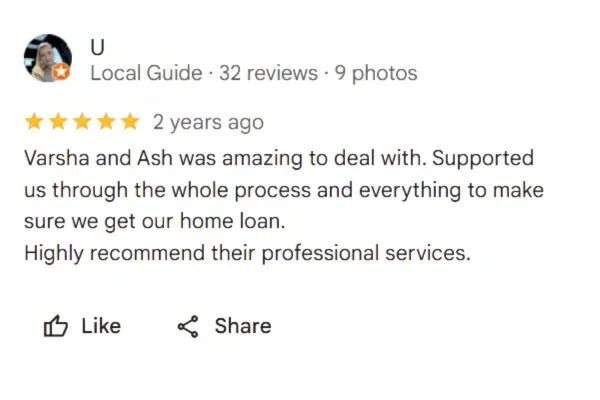

Ash Malik

Your Go-To Partner for a Smooth

Homeownership Journey

Why Health Care professionals Trust LTE Loans

Save up to $15,000 in Lenders Mortgage Insurance*

Borrow up to 90% of the property value

Access to lenders who understand Health Care Professionals

First Home Buyer Guarantee support

Overtime and allowances count toward your income

No upfront fees. We’re paid by the lender

Fast pre-approval process

No judgment on previous rejections

Fully licensed and Australian-owned

Why We Built LTE Loans

Ash Malik

Your Go-To Partner for a Smooth

Homeownership Journey

Ash saw too many Health Care Professionals being denied home loans simply because their income didn't fit into the traditional mould. He kept seeing hard-working people like nurses, physios, and radiographers. All had strong and stable earning patterns but were pushed to the sidelines because their income didn't fit the 'full-time, permanent' box.

From locum contracts to casual hours, your work is essential. Yet the lending system was built for predictability, not reality. Ash knew this needed to change.

That’s why LTE Loans exists.

We’ve built deep lender relationships and specialised systems that cater to the way Health Care Workers earn. We’ve trained our team to look at your full income picture. That includes more than just the pay slips traditional banks rely on.

Whether you're buying your first home, refinancing, or relocating for work, we understand what matters to you. Fast approvals. Respectful service. Clear communication. And no judgment.

With years of experience in healthcare lending, Ash and his team have now helped thousands of professionals like you move from stuck to settled. They do it with empathy, insight, and industry knowledge you can rely on.

We believe every health professional should be treated with the same care and respect they give their patients.

How It Works (It’s Easier Than You Think)

STEP 1

Tell us a bit about your goals (buying or refinancing)

We ask a few quick questions about your job, income, and goals. No credit check or paperwork needed.

STEP 2

We’ll review over 30 lenders to find those who value your income structure

We compare your profile against a panel of lenders who understand shift work, casual hours, and Health Care Professionals income types.

STEP 3

Get matched with tailored loan options.

You’ll get a shortlist of suitable loan options. Once you choose the most suitable fit, we handle the paperwork, submission and communication with the lender.

STEP 4

Choose what works for you. We’ll handle the admin, back-and-forth, and lender paperwork

We’ll guide you every step of the way through to settlement. That means fewer delays and a smoother experience.

How We Compare to Traditional Loan Paths

| Feature | Go Direct to a Lender |  |

|---|---|---|

| Deposit Requirement | Often 10–20% | From 5% (if eligible) |

| LMI Waiver Access | Varies | We help you access available waivers |

| Income Flexibility | Depends on lender | We match lenders who consider bonuses, overtime, contract income |

| Scheme Participation | Some support FHB schemes | We actively match you to those that do |

| Choice of Lenders | One lender only | Access to 30+ lenders |

| Personal Support | Limited | End-to-end broker support |

| Cost to You | May apply | $0 – the lender pays us |

Disclaimer: Your actual home loan rate may vary based on your individual circumstances. Speak to one of our expert brokers for a personalised quote.

Got Questions? Here's What Aussie Health Workers Ask Us The Most

Can I apply if I’m on a contract, short-term, or casual income?

Yes. That’s exactly who we help every day.

How do you get paid?

We’re paid by the lender when you proceed with a loan — never by you.

What if I’ve already been declined elsewhere?

We work with lenders who assess your full income story, not just what’s easy to checkboxes. Many of our clients come to us after hearing no elsewhere.

Do you help with government grants or guarantees?

Yes. We’ll check your eligibility for schemes like the First Home Buyer Guarantee and explain how they work.

How long does the process take?

Initial options can be available within 24–48 hours. Full approval depends on the lender and documentation.

You're One Step Away From Clarity and Support

We know how much time, energy, and heart you give to your work. The last thing you need is more complexity and confusion when it comes to getting a home loan.

At LTE Loans, we’re here to make it simple, human, and genuinely helpful.

Whether you’re refinancing, buying your first home, or just want a second opinion, our team is ready to walk with you through it.

You’ll never be left wondering what’s next. You’ll never feel rushed or judged.

Just open, honest guidance from people who understand your profession and care about your outcome.

Let’s help you take that next step with confidence.

©2025 All Rights Reserved | LTE Loans

LTE Loans Pty Ltd - ABN: 42 155 864 663 is a credit representative of Australian Credit License Number 483239

Disclaimer: The information contained on this site is general in nature. Always seek professional advice before making any financial decision.

*The estimated savings of up to $80,000 are based on avoiding Lenders Mortgage Insurance (LMI) on a loan amount of $800,000 at 90% LVR and accessing a lower interest rate typically reserved for eligible Health Care professionals. This includes an estimated $20,000–$25,000 LMI saving and potential interest savings over the life of a 30-year loan. Actual savings will vary depending on your individual circumstances, lender policies, loan size, interest rate, and eligibility. This information is general in nature and does not constitute personal financial advice. Credit assistance is provided under the relevant Australian Credit License.